CCTV News: On May 16, the China Securities Regulatory Commission officially announced and implemented the newly revised "Management Measures for Major Asset Restructuring of Listed Companies", which will support the merger and acquisition of listed companies with multiple "first time" and greater efforts.

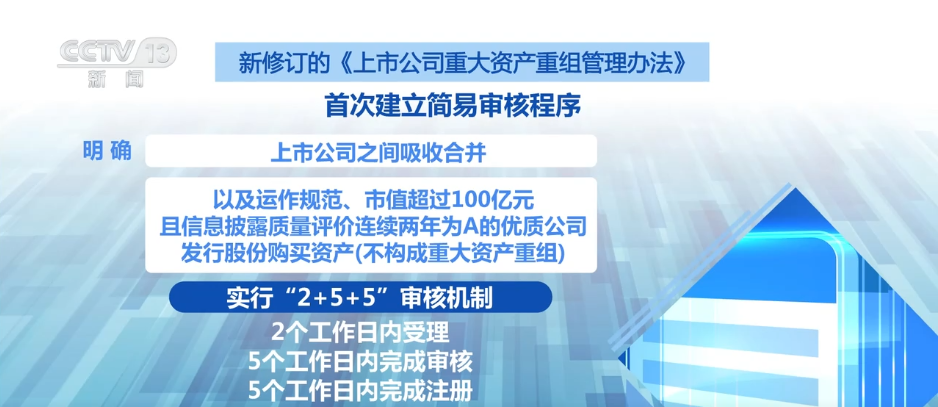

The newly revised "Management Measures for Major Asset Restructuring of Listed Companies" has established a simplified review procedure for the first time. It is clarified that the absorption and merger between listed companies, as well as the operational standard, the market value exceeds 10 billion yuan and the information disclosure quality evaluation is A for two consecutive years (does not constitute a major asset restructuring), and the "2+5+5" review mechanism is implemented, that is, the acceptance is carried out within 2 working days, the review is completed within 5 working days, and the registration is completed within 5 working days.

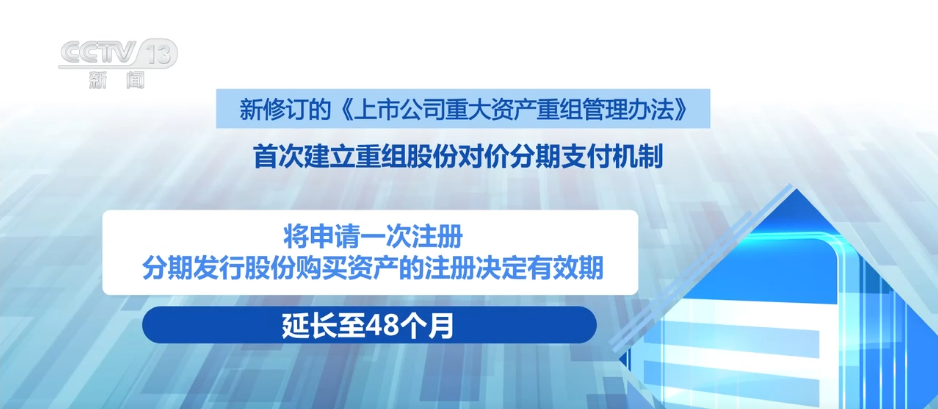

The new regulations establish a installment payment mechanism for restructuring shares for the first time, extending the validity period of the registration decision to apply for one registration and installment issuance of shares to purchase assets to 48 months. The innovative system design of installment payment fully meets the needs of listed companies to flexibly arrange transaction plans, especially in the case of large valuations of technology-based enterprises, and fully protects the interests of listed companies.

For the first time, the new regulations have improved the tolerance for changes in the financial status of listed companies, peer competition and related transaction supervision. On the basis of respecting market laws and industrial development needs, the institutional costs of mergers and acquisitions of listed companies have been reduced.

Arrangement for the introduction of private equity funds for the first time

The newly revised "Management Measures for Major Asset Restructuring of Listed Companies" encourages private equity funds to participate in mergers and acquisitions and reorganizations of listed companies, and introduces the "reverse linkage" arrangement for the first time.

The new regulations implement a "reverse linkage" to the investment period of private equity funds with the lock-up period of shares acquired by restructuring, and clearly state that if the investment period of private equity funds exceeds 48 months, the lock-up period in third-party transactions will be shortened from 12 months to 6 months, and the lock-up period as a small and medium shareholder during restructuring and listing will be shortened from 24 months to 12 months.

This institutional arrangement helps encourage private equity funds to participate in mergers and acquisitions and reorganizations of listed companies, effectively alleviate the problem of "difficulty in exit", and smooth the virtuous cycle of fund fund fund fund fund financing, fund investment and financing, post-investment management, and capital exit.

China Securities Regulatory Commission: Since the beginning of this year, listed companies have disclosed more than 600 asset restructuring orders

The reporter learned from the China Securities Regulatory Commission that the "Opinions on Deepening the Reform of the Merger and Acquisition Market", that is, the "Six Articles on Merger and Acquisitions" have been released in the past eight months, and the activity of the M&A market has increased significantly. The Shanghai and Shenzhen stock markets have disclosed more than 1,400 asset restructuring orders, of which more than 160 major asset restructuring orders.

Since this year, listed companies have disclosed more than 600 asset restructuring orders, 1.4 times that of the same period last year. Among them, there were about 90 major asset restructuring orders, 3.3 times that of the same period last year. The scale of mergers and acquisitions and restructuring transactions hit a new high. Since the beginning of this year, the amount of major asset restructuring transactions that have been implemented has exceeded 200 billion yuan, 11.6 times that of the same period last year.

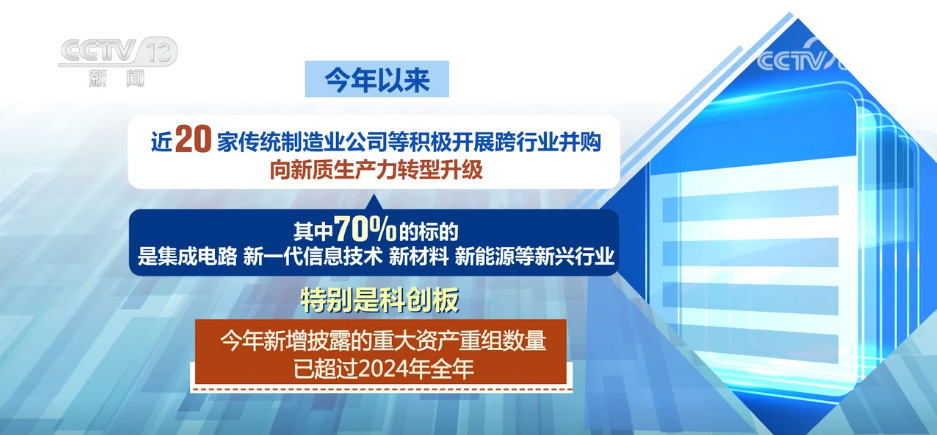

"Hard technology" mergers and acquisitions continue to emerge, promoting the development of listed companies to "new" and "quality". Since the beginning of this year, nearly 20 traditional manufacturing companies have actively carried out cross-industry mergers and acquisitions, transforming and upgrading to new quality productivity, of which 70% are emerging industries such as integrated circuits, new generation information technology, new materials, and new energy. Especially for the Science and Technology Innovation Board, the number of new major asset restructurings disclosed this year has exceeded the full year of 2024.