CCTV News: Recently, many foreign institutions have released reports, optimistic about China's assets.

The latest report from Goldman Sachs Group believes that this year the Chinese stock market has ushered in its best start in history. With recent breakthroughs in China's fields such as artificial intelligence and increasing policy support for technological progress, more and more overseas investment institutions have begun to consider increasing their holdings in Chinese stocks. In a recent report, Citi analysts raised the rating of China's stock market from "neutral" to "increasing holdings", and HSBC also raised the investment rating of Chinese stocks from "neutral" to "higher". Many foreign institutions began to reassess the value of Chinese assets, especially the valuation of technology stocks.

Wang Xinjie, chief investment strategist at Standard Chartered China Wealth Solutions Department, said that the revaluation of the value of technology stocks driven by DeepSeek has also driven the prospect of revaluation of China's assets, and Chinese technology stocks have begun to attract market attention. Duan Bing, an analyst at Nomura China's technology and telecommunications industry, said that China has sufficient development momentum in the field of science and technology innovation and is very optimistic about the future development direction.

JP Morgan believes that the revaluation of the value of Chinese technology stocks will continue, and the average annual return rate can reach 7.8% in the next 10 to 15 years. Morgan Stanley China stock strategist said that now is the best time to recommend global investors to increase their allocation to Chinese stock assets. Goldman Sachs believes that it should continue to increase its holdings in China's H shares and A shares. Institutions such as Forda International and BlackRock Fund said that from the perspective of the global market, with the advancement of technological innovation, China is expected to produce more exciting innovative concepts.

From research to investment, foreign-invested institutions have begun to take action

The reporter learned that in the recent institutional research team received by many listed companies, foreign-invested institutions are increasing, and some overseas investors have begun to increase their investment in Chinese assets.

After entering March, foreign institutions including South Korea Future Assets, Allianz Investment, HSBC Global Assets, Morgan Stanley, Schroders Investment and Fidelity Management Investment have appeared on the research list of listed companies. It is understood that in addition to their own investment needs, more and more overseas investors are increasing their attention to Chinese assets, which is also the reason why these institutions are stepping up their efforts to conduct research. Wang Xinjie introduced that from the perspective of the Asia-Pacific region, the number of consulting customers in investor and clients including South Korea, Singapore, Malaysia and the Middle East is increasing.

The latest data from the Korea Securities Depositary and Settlement Institute showed that the monthly transaction volume of Korean investors investing in mainland China and Hong Kong stocks in February reached US$782 million, a month-on-month increase of nearly two times, not only hitting a new high since August 2022, but also far exceeding the scale of Korean investors' investment in European and Japanese stock markets during the same period. From February 17 to 28, Chinese stocks accounted for six of the top ten overseas stocks in the net purchase scale of South Korean investors. As of the end of February, there were 44 Chinese index ETF funds listed on the Korean exchange, among which the largest increase in the ETF fund had a yield of as high as 62.8% in the past month.

Goldman Sachs' report pointed out that global investment management companies have been increasingly involved in Chinese capital market transactions recently, including new share issuance and allocation. As China's assets are price-performance, the inflow of international long-term funds will continue. The latest figures from the State Administration of Foreign Exchange show that in February, foreign capital increased its holdings of domestic bonds and stocks totaling US$12.7 billion.

Expert analysis: Why are international investors optimistic about Chinese assets?

Experts believe that from foreign institutions to international investors, the most important reason for optimism about Chinese assets is their optimism about the Chinese economy and the big market in China, which also strengthens their recognition of the long-term value of Chinese assets.

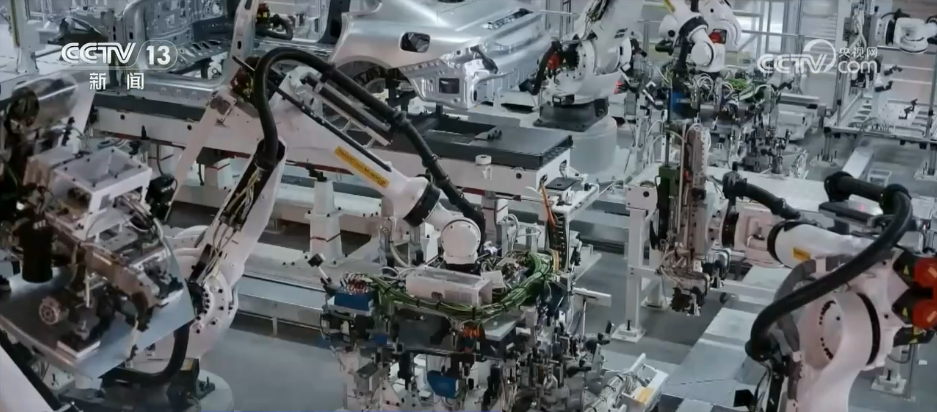

A series of economic data recently released shows that with the arrival of spring, China's economy is accelerating upward growth. In February, China's small and medium-sized enterprise development index hit its highest value in the past four years; China's manufacturing purchasing managers' index (PMI) rose by 1.1 percentage points month-on-month, and the manufacturing industry's prosperity level rebounded significantly. Since the beginning of this year, my country's service industry has increased its efforts to open up foreign investment, and pilot projects have been launched in multiple fields such as value-added telecommunications and medical care. Since the beginning of the year, China's innovation in cutting-edge scientific and technological innovation fields such as robots, artificial intelligence, game development, and brain-computer interfaces has attracted global attention.

This year's government work report has written "stabilizing the real estate market and stock market" into the overall requirements for the first time, injecting more new momentum into the long-term and stable development of China's assets, and further enhancing global investors' confidence in China's assets.

The policy information revealed by the just-concluded Two Sessions, more active fiscal policies, timely reduction of reserve requirement ratio and interest rate cuts, and more policies to boost consumption, cultivating and strengthening more dynamic emerging industries, future industries, etc., has also allowed many foreign institutions to see the potential and driving force of China's economic growth. From the perspective of the capital market itself, with more high-tech enterprises going public, the technological content of my country's capital market has increased significantly. At the same time, the bottlenecks in the market entry of medium and long-term funds such as social security, insurance, and financial management will also be opened up one by one. The Chinese stock market will usher in more medium and long-term funds entering the market, and the stability of China's assets is expected to further improve.