Originally, you can make an appointment for personal income tax annual reconciliation! "Three-step" teaches you how to handle it

Today (February 21) starts at 6:00, and you can make an appointment for personal income tax reconciliation in 2024. How to get the tax refund "red envelope", let's take a look at the operation steps ↓

What is the personal income tax annual reconciliation?

Annual reconciliation refers to the process in which after the end of the year, the taxpayer combines the four comprehensive income obtained in the year, including wages, salary, labor remuneration, royalties, and royalties obtained throughout the year, and obtains personal income tax, and declares to the tax authorities and handles tax refunds or tax reimbursement.

Comprehensive income, an excess progressive tax rate of 3% to 45%.

When can be handled?

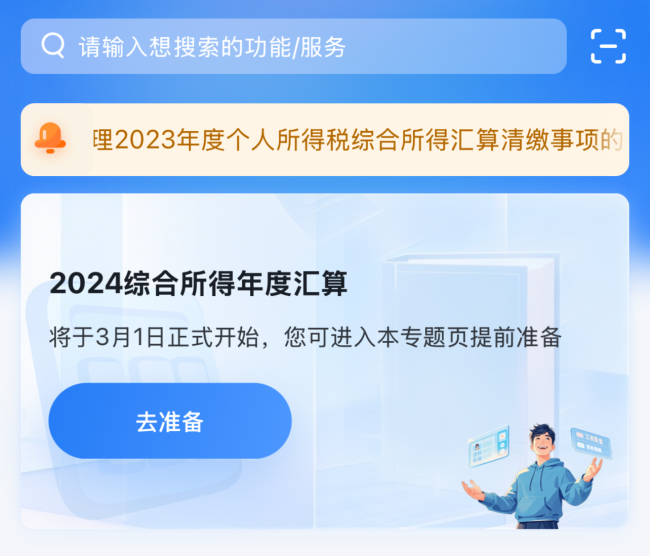

March 1 to June 30, 2025. It spans 4 months and is processed at any time 24 hours a day. Taxpayers do not need to gather in a few days before.

If taxpayers need to handle the annual reconciliation between March 1 and March 20, they can log in to the mobile personal income tax app to make an appointment from 6:00 to 22:00 every day from February 21 to March 20 to make an appointment.