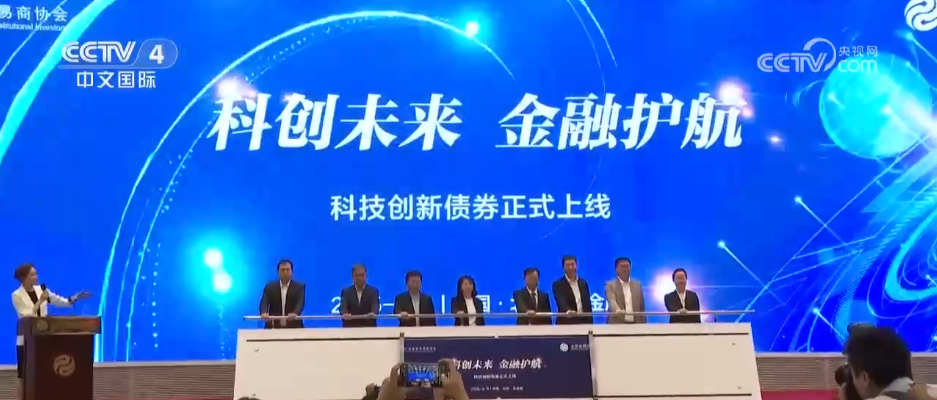

CCTV News: In order to stimulate the driving force for scientific and technological innovation and market vitality and broaden the financing channels for scientific and technological innovation enterprises, the People's Bank of China and the China Securities Regulatory Commission jointly issued an announcement on supporting the issuance of scientific and technological innovation bonds on May 7. On May 9, the first batch of 36 technology innovation bonds were issued online in the interbank market.

The first batch of 36 technology innovation bonds include 22 technology-based enterprises and 14 equity investment institutions, with a total scale of 21 billion yuan. The project covers 10 provinces and cities including Beijing, Shanghai, Guangdong, Jiangsu, and Zhejiang. The industry involves many cutting-edge emerging fields such as integrated circuits, intelligent computing centers, and new materials. Cao Yuanyuan, deputy director of the Financial Markets Department of the People's Bank of China, said that science and technology innovation bonds are financing tools specifically used in the field of science and technology innovation, and have the advantages of accurate direct access, flexible maturity and controllable costs. To provide more efficient, convenient and low-cost incremental funds for the field of scientific and technological innovation, the issuance of scientific and technological innovation bonds will surely drive more funds to support private enterprises in carrying out scientific and technological innovation activities and help cultivate new quality productivity.

In addition, the 20 billion yuan science and technology innovation bond of the State Development Bank was also successfully issued on the 9th. The funds raised will be used to support national technological innovation demonstration enterprises, manufacturing single champion enterprises and other technology-based enterprises, as well as high-tech manufacturing, strategic emerging industries, intellectual property-intensive industries, etc.

According to the announcement of the People's Bank of China and the China Securities Regulatory Commission, three types of institutions, including financial institutions, technology-based enterprises, private equity investment institutions and venture capital institutions, can issue technology innovation bonds and raise funds to support investment and financing in the field of technology innovation.