CCTV News: The 2025 government work report proposes that laws, regulations and policies and measures to promote the development of the private economy should be implemented in a solid manner. On March 12, many financial institutions announced specific measures to innovate financial service models and increase their efforts to provide financial support to various private enterprises.

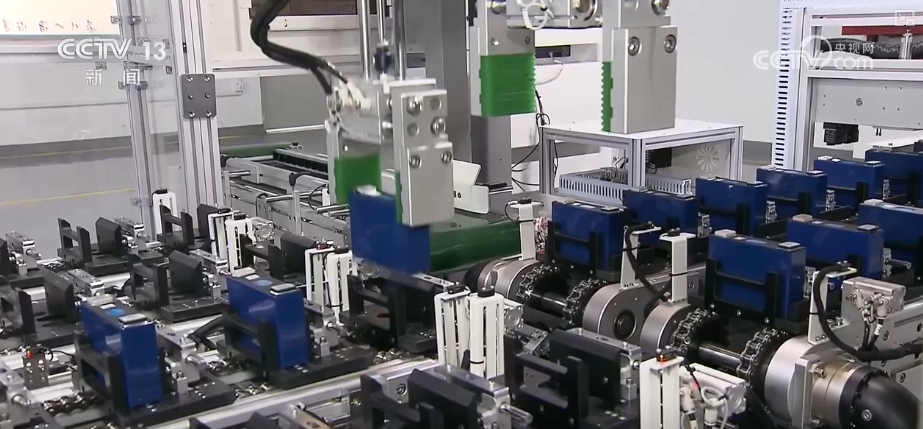

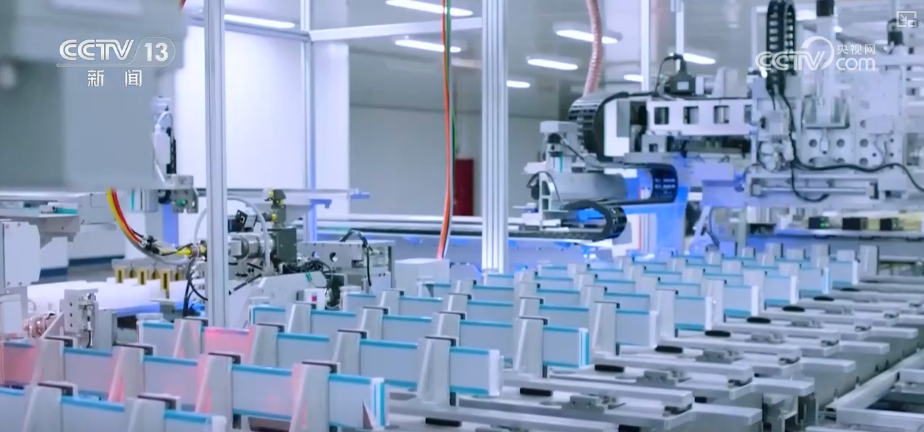

On March 12, the All-China Federation of Industry and Commerce and Industrial and Commercial Bank of China jointly issued an action plan to empower the high-quality development of the private economy. "Ten Major Measures" will be launched around science and technology finance, green and low-carbon, etc., to support private enterprises to strengthen independent innovation and develop new quality productivity.

ICBC Chairman Liao Lin introduced that it is planned to provide investment and financing for private enterprises no less than 6 trillion yuan in the next three years. Focusing on solving the pain points and difficulties of private enterprises, we will facilitate full-scope financing in stocks, bonds, loans, insurance, etc., and increase credit and medium- and long-term funding supply.

Agricultural Bank takes "artificial intelligence +" as the direction to promote the construction of a smart technology financial service platform. Bank of China announced that it will use digital means to serve private enterprises in 2025 for more than 5 trillion yuan. At the same time, it will provide more powerful financing support for private enterprises to "go overseas" projects.

Bank China Chairman Ge Haijiao introduced that financial support for private enterprises to deeply participate in the joint construction of the "Belt and Road". In 2025, it is planned to support private enterprise projects with an intention to raise more than US$5 billion. Break down bottlenecks and pain points in financial services, and eliminate unequal clauses in service processes such as risk preferences, credit policies, and credit approval.

On March 12, Industrial and Commercial Bank of China and Bank of China also announced the establishment of a science and technology innovation fund with a total scale of 80 billion yuan and a science and technology innovation parent fund with a total scale of more than 50 billion yuan to support equity financing of science and technology innovation enterprises and continue to increase support for hard technology and the private economy.