CCTV News: The State Administration for Financial Regulation recently issued a notice, clarifying that in 2025, financial services for small and micro enterprises should "maintain quantity, improve quality, stabilize prices and improve structure", help small and micro enterprises stabilize expectations, stimulate vitality, and promote the sustained recovery and improvement of the economy.

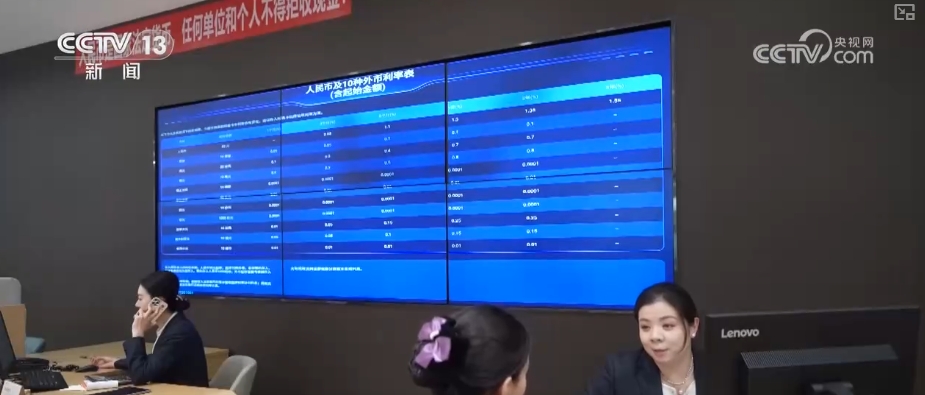

Protect quantity means maintaining credit support. To improve quality means to strengthen risk management and guide the improvement of credit quality of small and micro enterprises. To stabilize prices means to stabilize credit service prices, guide and strengthen loan pricing management, and reasonably determine the loan interest rate level of inclusive small and micro enterprises.

The State Administration for Financial Regulation proposed that in 2025, we must deepen the use of financial technology means, shorten the financing chain, and reduce the actual comprehensive financing costs borne by small and micro enterprises. We must guide and strengthen the exploration and cultivation of first-time lenders, increase the implementation of loan renewal policies, and make good use of credit loans and medium- and long-term loans. We must increase financial support for small and micro enterprises in foreign trade, private, technology, consumption and other fields, so as to achieve direct credit funds to the grassroots level, fast and convenient, and appropriate interest rates.

The notice also requires insurance companies to develop and promote insurance products that meet the needs of small and micro business entities, and improve their risk prevention capabilities in production and operation, technological innovation, sudden disasters, cargo transportation, etc. Further improve the service efficiency and online level of consultation, underwriting, claims and other links, appropriately simplify underwriting procedures and material requirements, and improve the timeliness of claims.