CCTV News: Pay attention to capital market trends. Since the beginning of this year, among the new stocks listed on the A-share and Hong Kong stock market, the number of technology companies accounts for a relatively large proportion, reflecting the capital market's emphasis on technological innovation.

In the past half month, six more A-share companies have been approved by the China Securities Regulatory Commission and are about to enter the capital market. Wande data shows that as of February 23, a total of 13 new A-share stocks were listed this year, including 4 of the Science and Technology Innovation Board and the ChiNext Board and 2 of the Beijing Stock Exchange, accounting for nearly 77%. Some new stocks performed well on the first day of listing, and investors' enthusiasm for participating in new stocks has also increased significantly.

Lu Zhe, chief economist of Dongwu Securities, said: "At present, the investment and trading atmosphere in the overall A-share market is active, with trading volumes of more than one trillion yuan for many consecutive days, and investor confidence has increased. Moreover, whether it is new stocks or companies under review, most of them focus on advanced manufacturing, new energy and other fields, with strong innovation attributes, which is also the main focus of national policies and markets. This also provides a channel for financing for technological innovation enterprises and helps enterprises develop at a high-quality level."

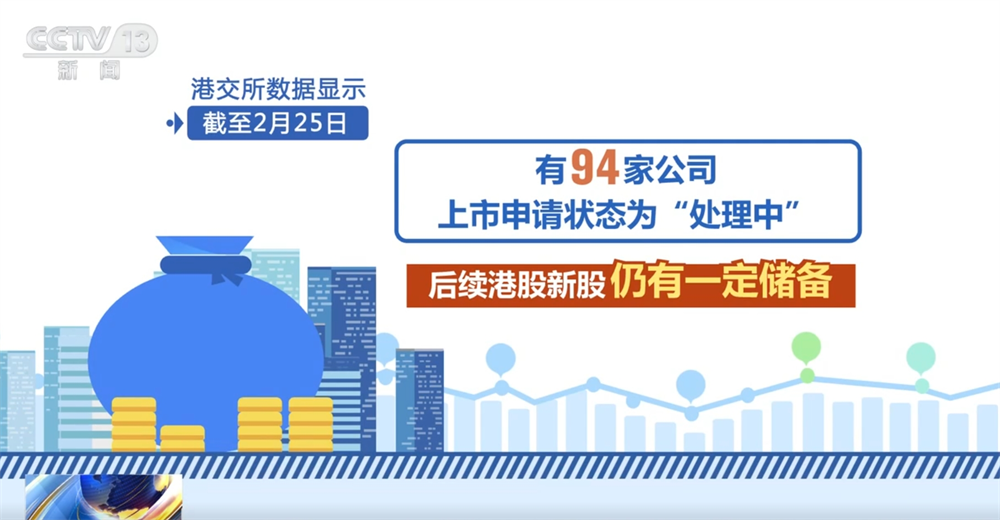

Wand data shows that in the past two weeks, another consumer service company has been listed in the Hong Kong stock market. As of February 25, a total of 9 new stocks in Hong Kong stocks have been listed this year. Data from the Hong Kong Stock Exchange shows that as of February 25, 94 companies had listing applications in the "processing", which also means that there are still certain reserves for new Hong Kong stocks in the future.

Li Yan, managing director of the Capital Marketing Department of CICC, said: "From the perspective of industry distribution, consumption, technology, industry and medical care account for a high proportion, and strong technological attributes. In terms of capital use, expanding overseas sales, supply chain and R&D capabilities is the main direction, which shows that enterprises are increasingly paying attention to the use of international financing platforms for development in the global development. This is also a concrete manifestation of the active support of qualified domestic enterprises to go abroad to go public in recent years, and better utilize the two markets and two resources at home and abroad. More high-quality mainland enterprises listed in Hong Kong can also enhance the attractiveness of Hong Kong stocks in the world, which is conducive to global investors sharing China's growth dividends."

Investment risk warning: "New stocks" need to be cautious and understand the basic situation of the company

Investors purchase newly listed stocks commonly known as "new stocks". Recently, investors' enthusiasm for "new stock investment" has increased. Experts remind that in the process of "new stock investment", investors cannot blindly speculate on topics and should know more about the basic situation of the company.

Tian Lihui, director of the Institute of Financial Development of Nankai University, said that for ordinary investors, the first thing they should remember is that "entering new stocks" does not mean that "entering new stocks" does not mean that it is stable to make profits and there is also the possibility that the stock price falls below the issue price, so you must have psychological expectations. At the same time, you cannot just look at the name of the stock. You must first find out what the company does, whether it makes money or not, and what the industry prospects are. You must have some understanding of the company's basic situation before making a judgment. With the rule design of multiple different sectors, the fluctuations in the listing of new stocks will be greater than in the future. You must not be greedy and think of trading strategies in advance.