CCTV News: On the afternoon of February 14, the People's Bank of China released the January financial statistics and social financing scale report. Many indicators were better than market expectations, providing strong financial support for a stable start to the economy at the beginning of the year.

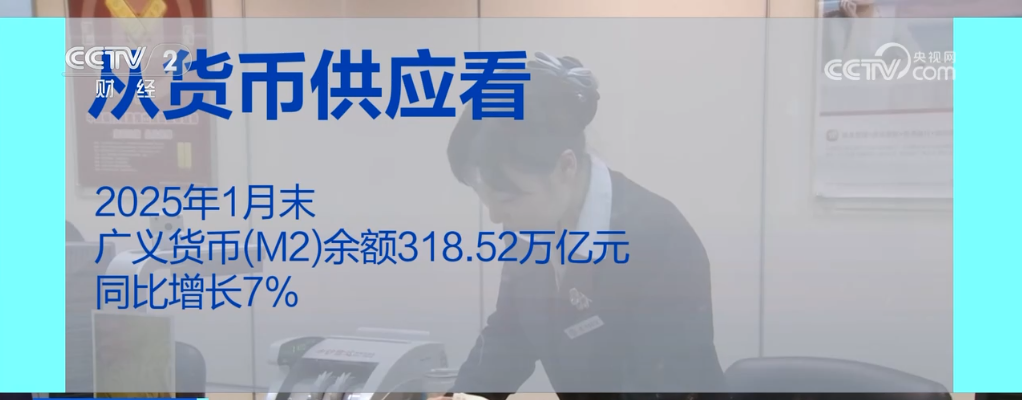

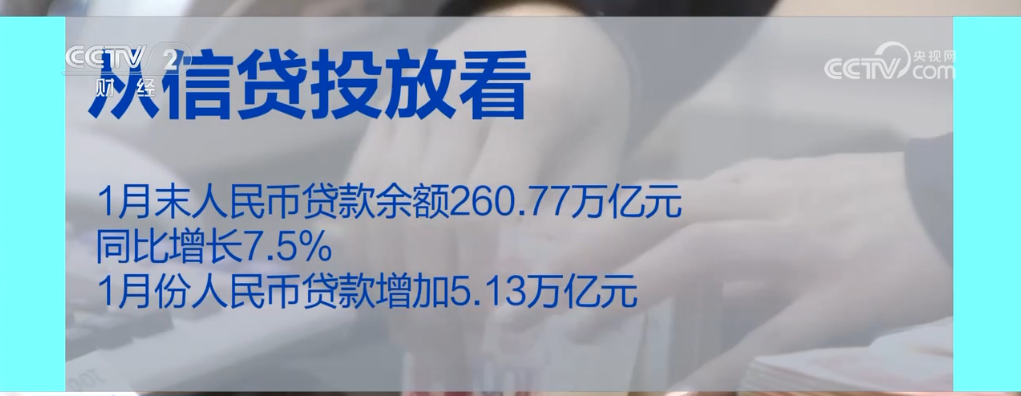

From the perspective of money supply, at the end of January 2025, the balance of broad currency (M2) was 318.52 trillion yuan, a year-on-year increase of 7%. From the perspective of credit supply, at the end of January, the balance of RMB loans was 260.77 trillion yuan, an increase of 7.5% year-on-year; in January, RMB loans increased by 5.13 trillion yuan, an increase of 213.3 billion yuan year-on-year.

Experts said that credit growth is quite impressive. In January, the new loan increase was slightly higher than the high base of 4.9 trillion yuan in the same period last year. Since the beginning of the year, the financial system has increased its credit supply, fully met the effective financing needs of the real economy, promoted the transmission of loose monetary to loose credit, and reflected the monetary policy tone of "moderate looseness".

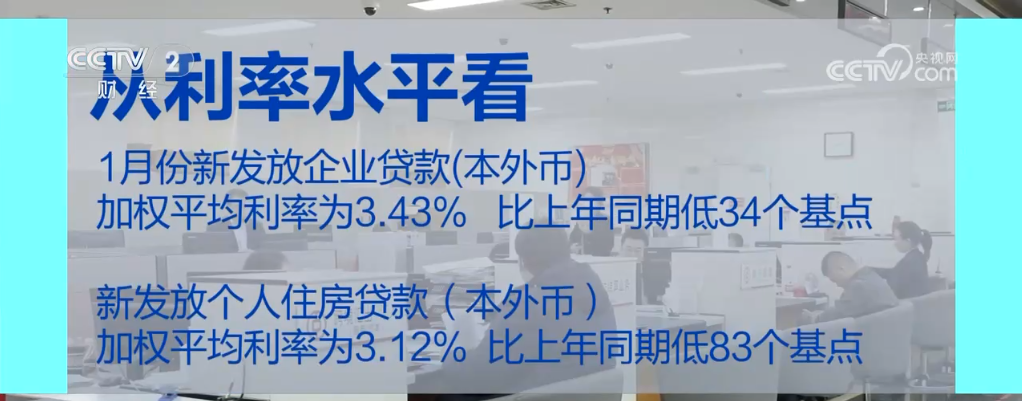

The interest rate for newly issued corporate loans in January remained at a historical low

From the interest rate level, loan interest rates continue to remain at a historical low. In January, the weighted average interest rate of newly issued corporate loans (domestic and foreign currencies) was 3.43%, 34 basis points lower than the same period last year; the weighted average interest rate of newly issued personal housing loans (domestic and foreign currencies) was 3.12%, 83 basis points lower than the same period last year.

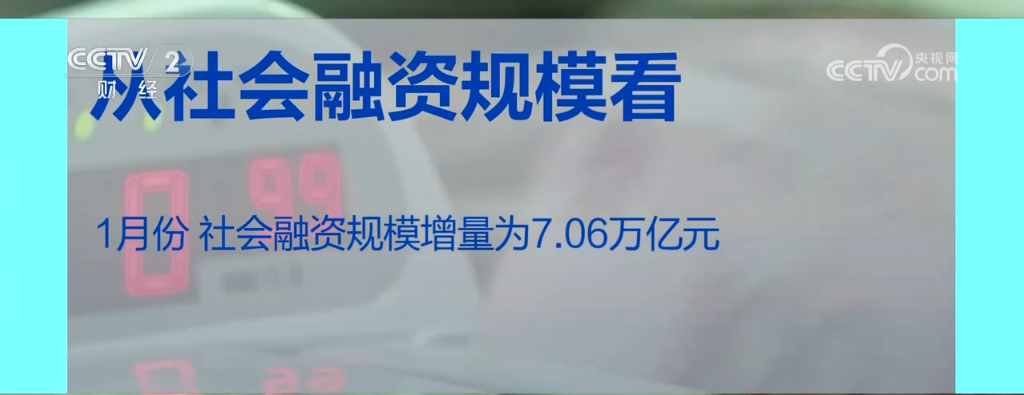

In terms of the scale of social financing, in January, the increase in the scale of social financing was 7.06 trillion yuan. Experts said that the "two double and two new" credit demand has been released at a faster pace. This year, major projects in various places have been striving to start construction as soon as possible, and drive rapid growth of infrastructure loans.